501 C 3 Forms Template - The term “501(c)(3)” refers to federal income tax. Use this template to create a donation receipt with minimal effort and improve donor engagement. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code.

The term “501(c)(3)” refers to federal income tax. Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. Use this template to create a donation receipt with minimal effort and improve donor engagement.

A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. Use this template to create a donation receipt with minimal effort and improve donor engagement. Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. The term “501(c)(3)” refers to federal income tax.

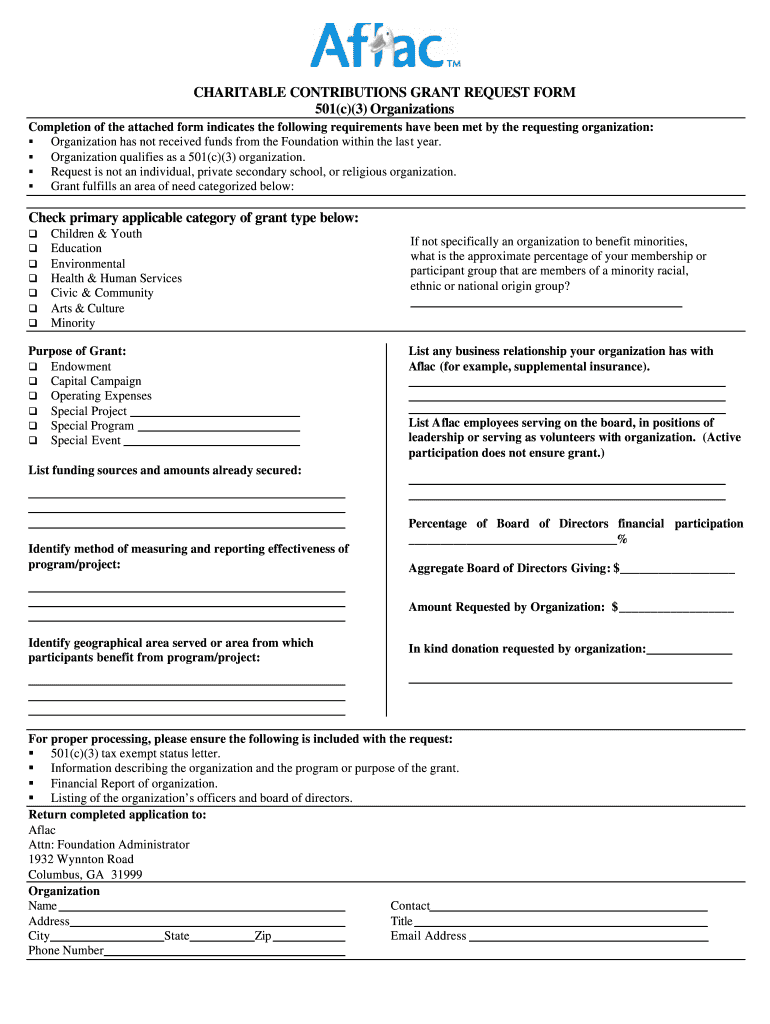

501(c)(3) Letter Bright Horizons Foundation

Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. The term “501(c)(3)” refers to federal income tax. Use this template to create a donation receipt with minimal effort and improve donor engagement. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received.

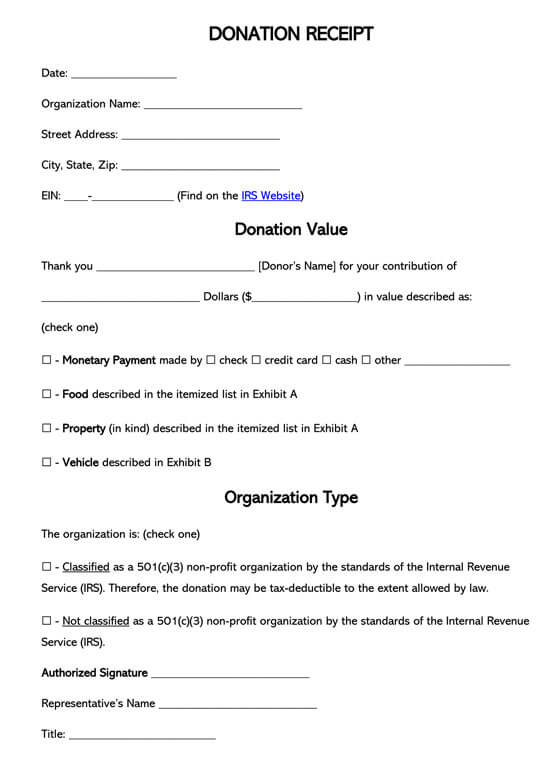

Free 501(c)(3) Donation Receipt Templates Word PDF

Use this template to create a donation receipt with minimal effort and improve donor engagement. The term “501(c)(3)” refers to federal income tax. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. Examples of organizing documents containing language required for an organization to qualify for.

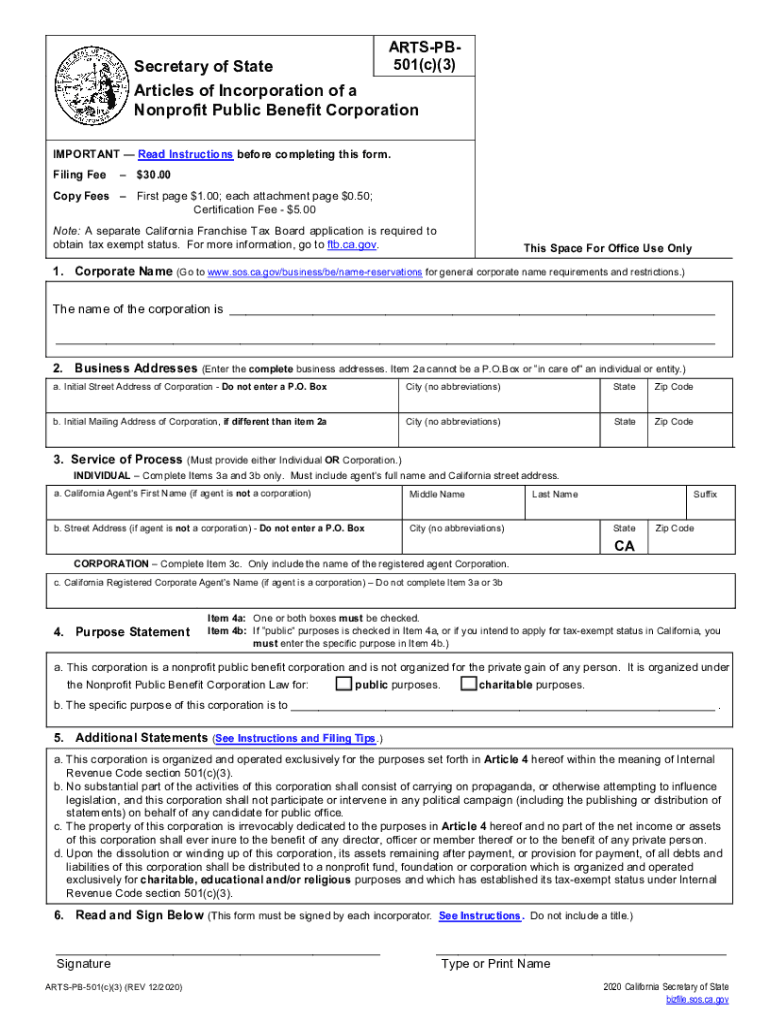

20202024 Form CA ARTSPB 501(c)(3) Fill Online, Printable, Fillable

Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. The term “501(c)(3)” refers to federal income tax. Use this template to create a donation receipt with minimal effort and improve donor engagement. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received.

501c3 Donation Receipt Template Business

A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. The term “501(c)(3)” refers to federal income tax. Use this template to create a donation receipt with minimal.

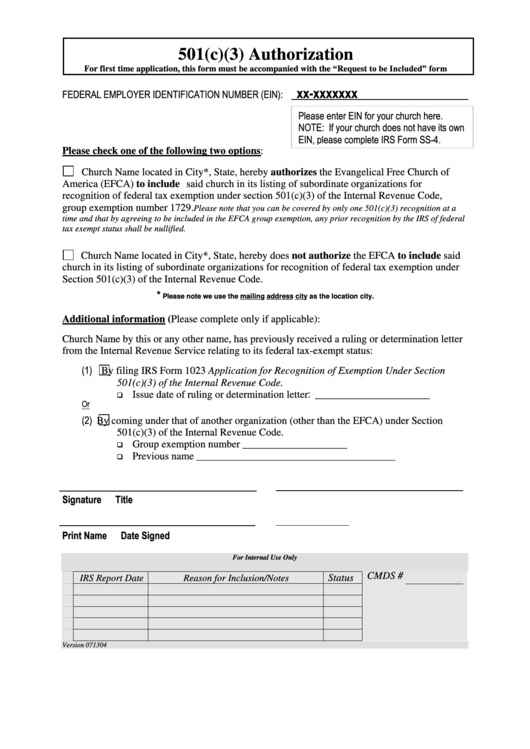

Tax Forms For 501c3 Organizations Form Resume Examples lV8NeRg30o

Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. Use this template to create a donation receipt with minimal effort and improve donor engagement. The term “501(c)(3)” refers to federal income tax. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received.

Top 501c3 Form Templates free to download in PDF format

The term “501(c)(3)” refers to federal income tax. Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. Use this template to create a donation receipt with minimal.

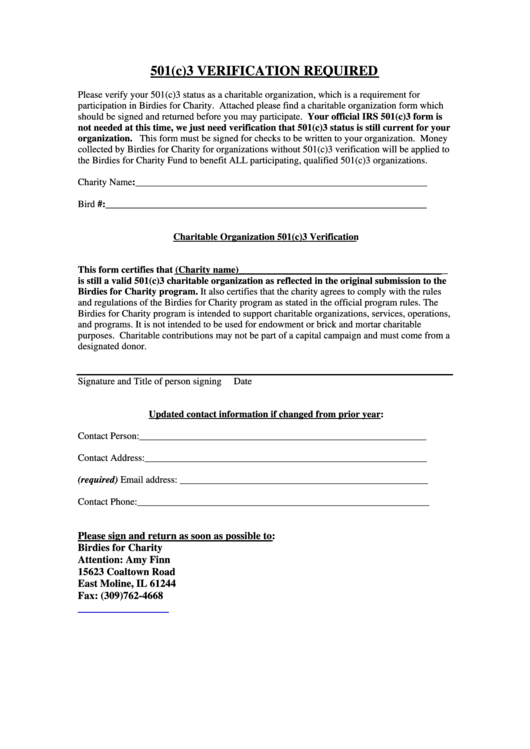

501(C)3 Verification Form printable pdf download

Use this template to create a donation receipt with minimal effort and improve donor engagement. Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. The term “501(c)(3)”.

Printable 501C3 Application

Use this template to create a donation receipt with minimal effort and improve donor engagement. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. The term “501(c)(3)” refers to federal income tax. Examples of organizing documents containing language required for an organization to qualify for.

What Are the Different Types of 501(c)(3) Organizations Doc

The term “501(c)(3)” refers to federal income tax. Use this template to create a donation receipt with minimal effort and improve donor engagement. Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received.

501c3 donation receipt template addictionary 501c3 donation receipt

The term “501(c)(3)” refers to federal income tax. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. Use this template to create a donation receipt with minimal effort and improve donor engagement. Examples of organizing documents containing language required for an organization to qualify for.

Use This Template To Create A Donation Receipt With Minimal Effort And Improve Donor Engagement.

Examples of organizing documents containing language required for an organization to qualify for exemption under internal revenue code. A 501(c)(3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another. The term “501(c)(3)” refers to federal income tax.