Balance Sheet Schedule L - If your corporation's total receipts for the tax year. Income tax return for an s corporation where the. Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l.

Income tax return for an s corporation where the. If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l.

If your corporation's total receipts for the tax year. Income tax return for an s corporation where the. First, make sure you actually have to file schedule l. Reconciliation of income (loss) per books.

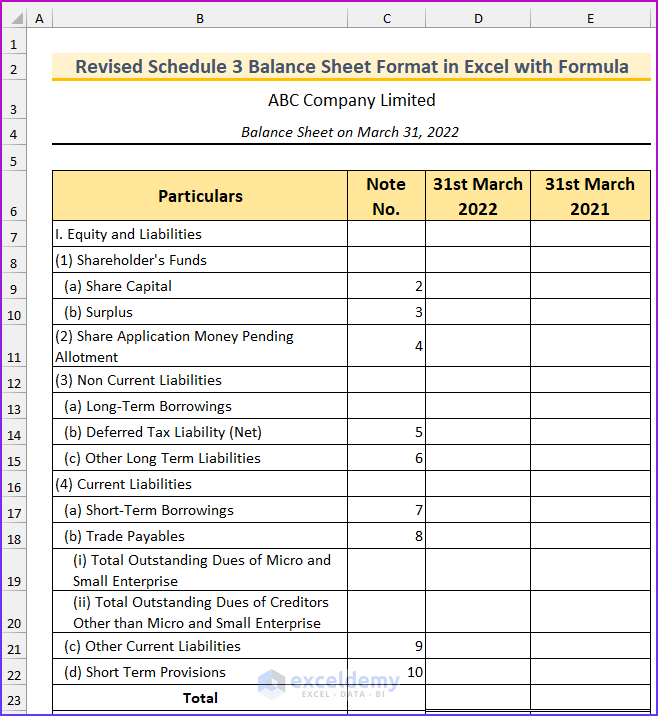

Jeune femme Ponctualité Prélude provisions balance sheet Ouaip

Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Income tax return for an s corporation where the.

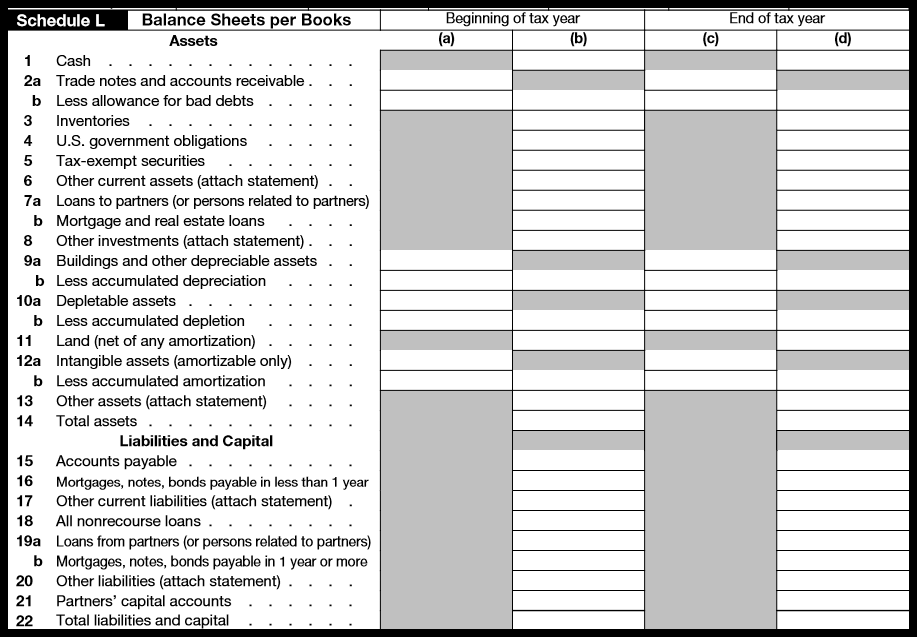

How To Complete Form 1065 US Return of Partnership

First, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books. Income tax return for an s corporation where the.

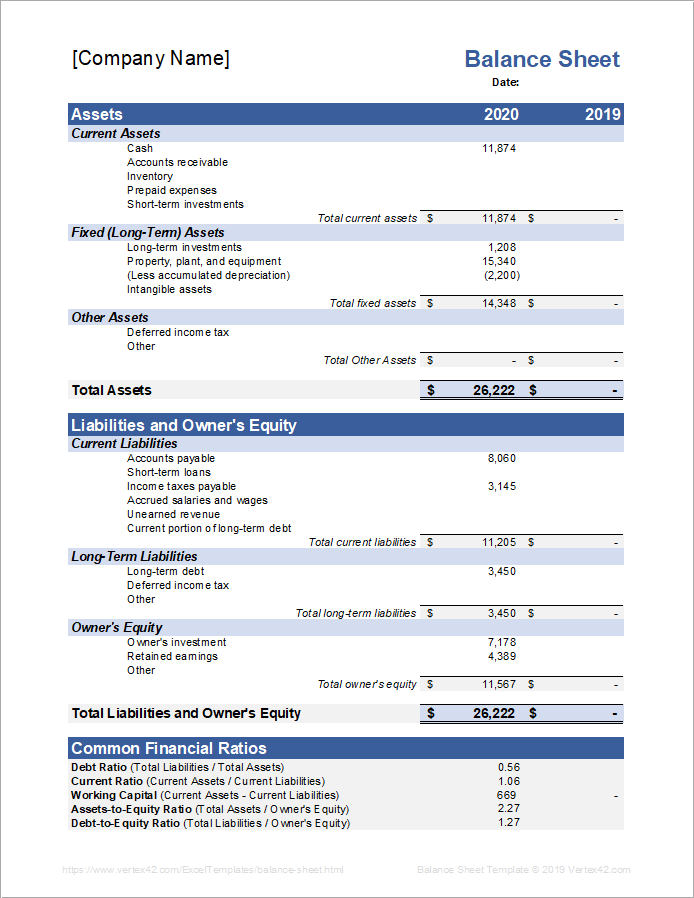

Pin on Free Templates Designs

Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l. Income tax return for an s corporation where the. If your corporation's total receipts for the tax year.

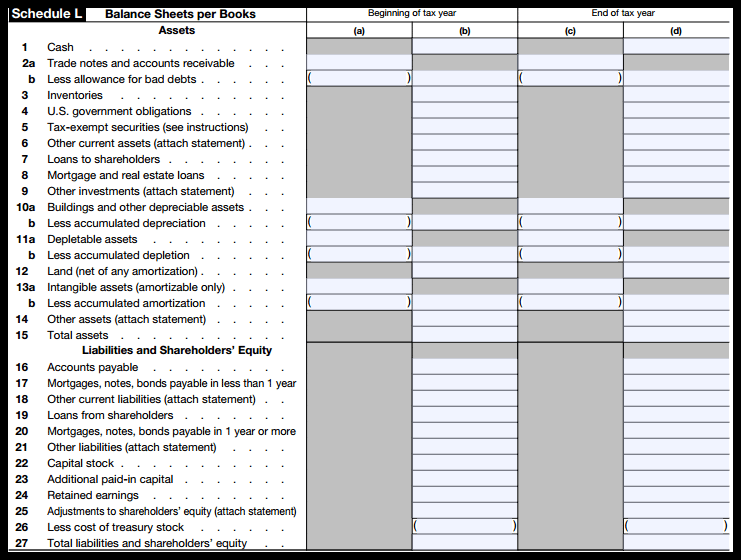

How to Complete Form 1120S Tax Return for an S Corp

Reconciliation of income (loss) per books. Income tax return for an s corporation where the. If your corporation's total receipts for the tax year. First, make sure you actually have to file schedule l.

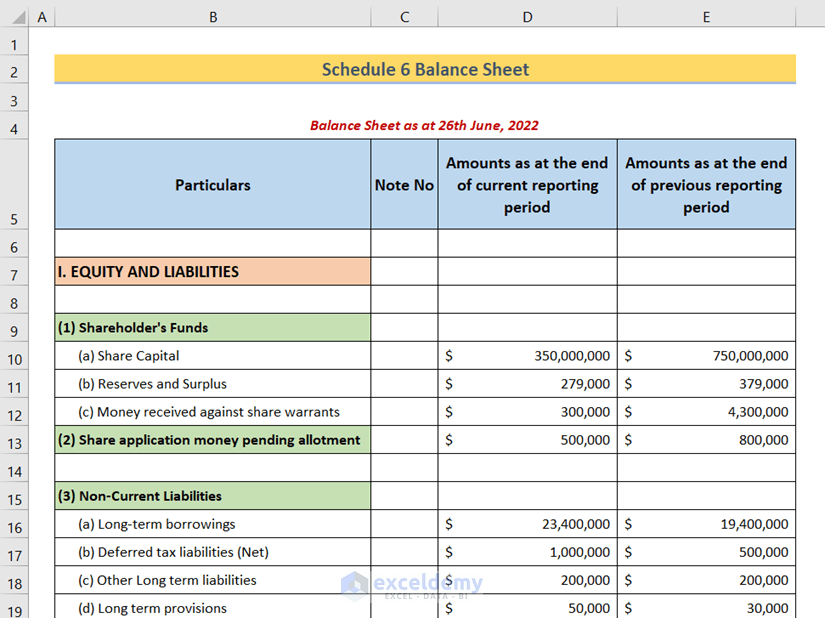

Sensational Schedule L Balance Sheet Example Format Excel Free Download

If your corporation's total receipts for the tax year. Income tax return for an s corporation where the. Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l.

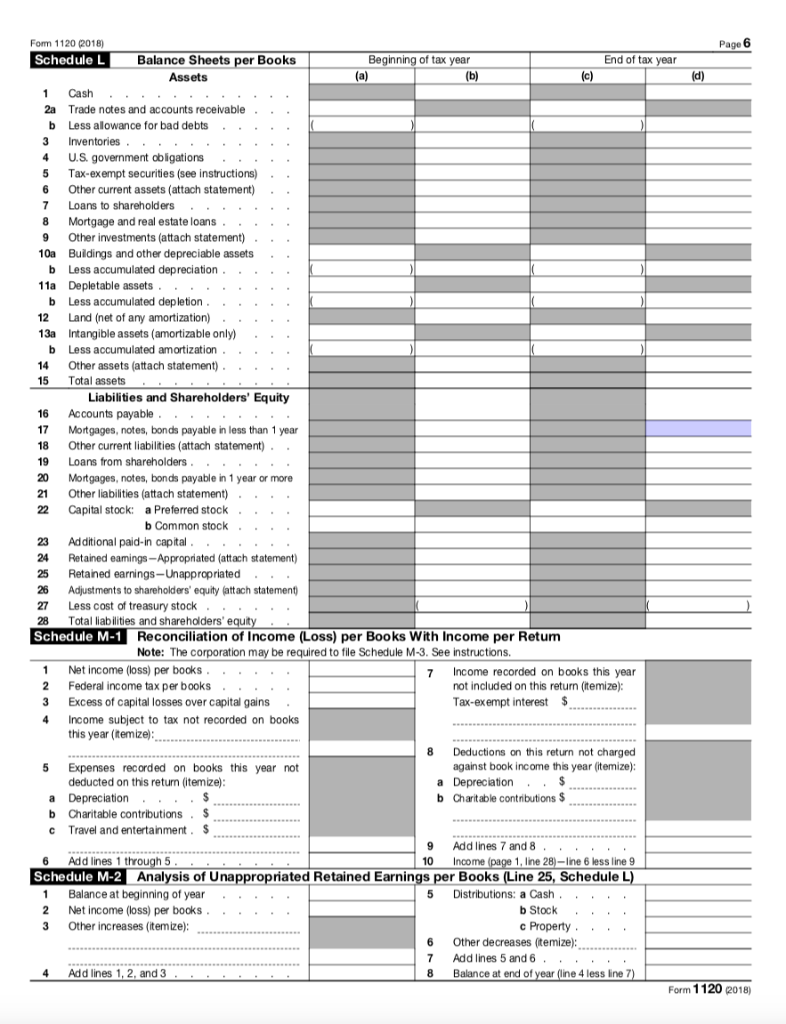

1120 EF Message 0042 Schedule M2 is out of Balance (M1, M2, ScheduleL)

Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Income tax return for an s corporation where the.

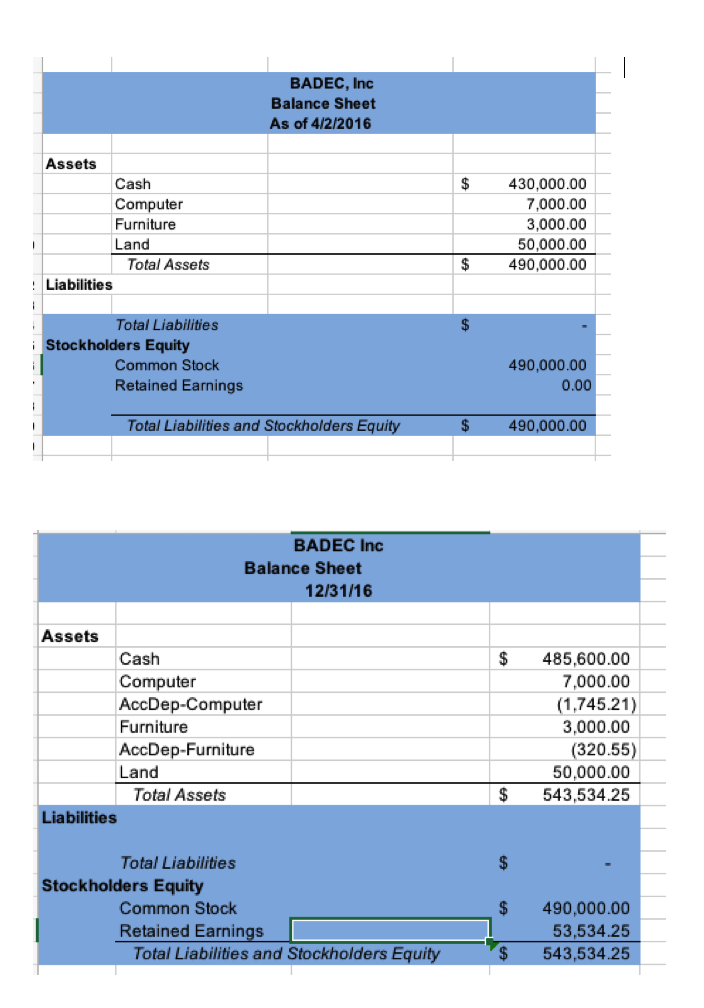

Solved Form complete Schedule L for the balance sheet

Income tax return for an s corporation where the. First, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books.

How to track your business finances all year long? GA advisor

Income tax return for an s corporation where the. Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year. First, make sure you actually have to file schedule l.

Form 7 Analysis Of Net Five Secrets About Form 7 Analysis Of Net

Income tax return for an s corporation where the. If your corporation's total receipts for the tax year. First, make sure you actually have to file schedule l. Reconciliation of income (loss) per books.

Income Tax Return For An S Corporation Where The.

Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year.