Cost Of Goods Sold Excel Template - The way, you can get rid of manual calculation and formatting. This figure includes materials and labor costs, but excludes indirect expenses, such as sales and distribution costs. Below is a screenshot of the cogs template: Web cost of goods sold formula. Review your gross profit (i.e., your gross revenue minus cogs) for accuracy. Enter the cost of goods sold by your company. Web cost of goods sold: Web cost of goods sold. Purchases are the total cost incurred from manufacturing to transporting goods and services. Leftover) from the prior period.

Purchases in current period → the cost of purchases made during the current period. Purchases are the total cost incurred from manufacturing to transporting goods and services. This figure includes materials and labor costs, but excludes indirect expenses, such as sales and distribution costs. Web cost of goods sold template has basic formulas or formats is make that calculation easier press automatic. Web smartsheet contributor andy marker april 6, 2022 try smartsheet for free creating a profit and loss statement can be daunting, but using a template can help simplify the process. Web cost of goods sold (cogs) =. Web cost of goods sold: Leftover) from the prior period. Beginning inventory → the amount of inventory rolled over (i.e. This figure tells anyone reviewing the financial statements how much it cost for the business to provide the goods and services it sells to customers.

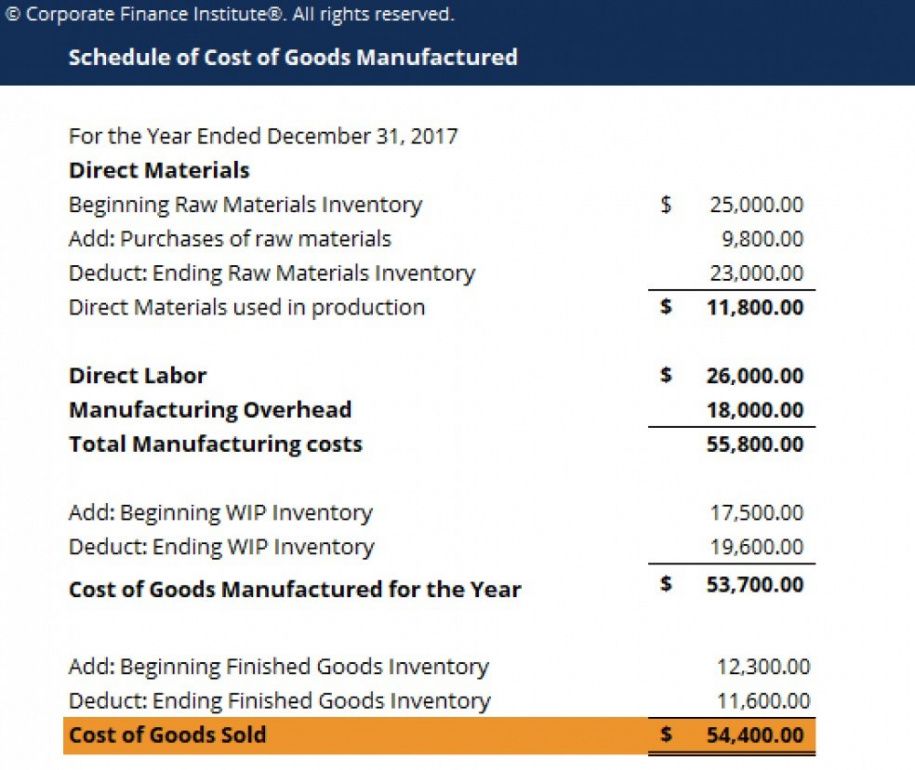

Web cost of goods sold formula. In the income statement for a business one of the key figures is the cost of goods sold (cogs). Fifo, lifo, and weighted average. Web cost of goods sold (cogs) template. Beginning inventory is the inventory value at the start of an accounting period. Purchases in current period → the cost of purchases made during the current period. Beginning inventory → the amount of inventory rolled over (i.e. Web cost of goods sold. Web cost of goods sold (cogs) =. Enter your name and email in the form below and download the free template now!

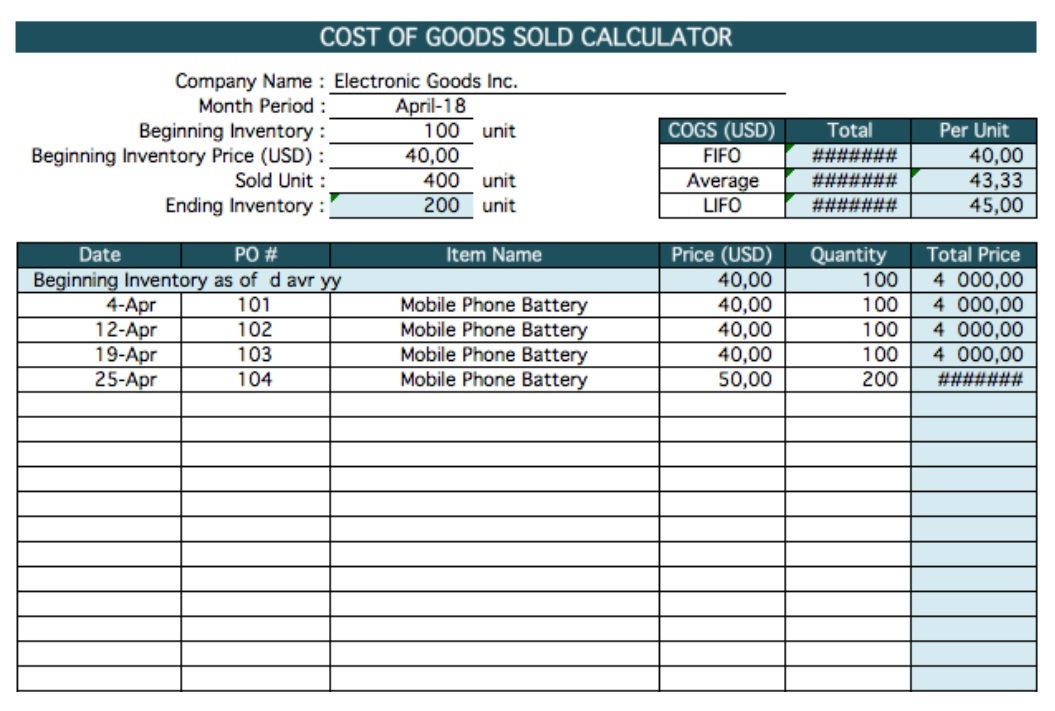

Cost of Goods Sold Calculator Excel Templates

Enter your name and email in the form below and download the free template now! Web cost of goods sold: The cost of goods (cog) forecast template and spreadsheet include categories for five types of your products and services, with slots for the cost of goods for each product or service and the number of products and services sold. Beginning.

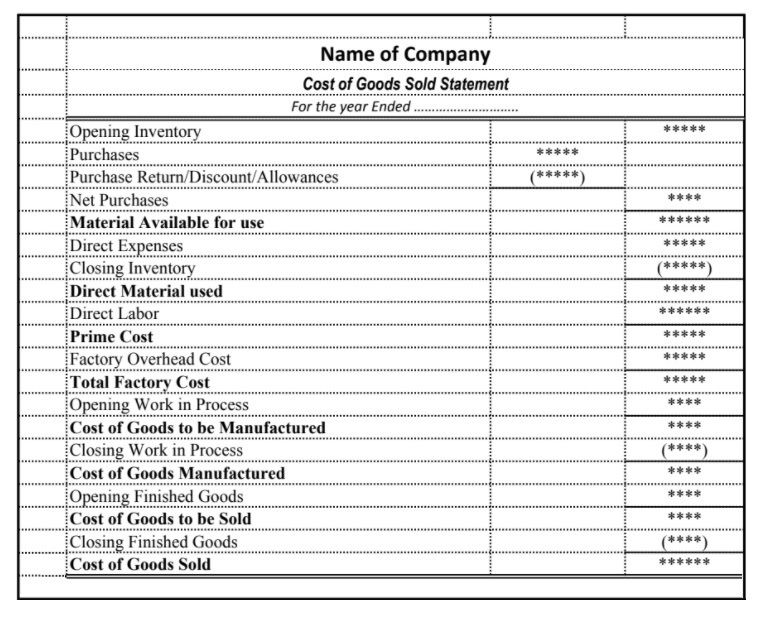

Cost of Goods Sold Statement Templates 13+ Free Printable Xlsx, Docs

Web cost of goods sold template has basic formulas or formats is make that calculation easier press automatic. Purchases in current period → the cost of purchases made during the current period. This cost of goods sold template demonstrates three methods of cogs accounting: Purchases are the total cost incurred from manufacturing to transporting goods and services. Beginning inventory →.

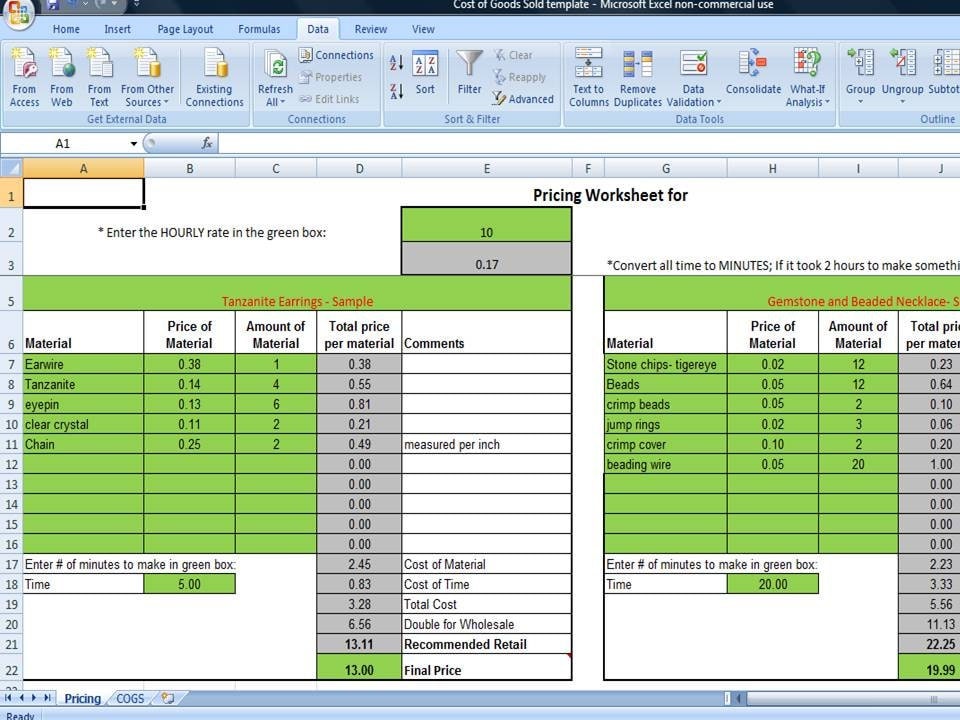

Cost of Goods Sold Spreadsheet Calculate COGS for Handmade

Web cost of goods sold: Below is a screenshot of the cogs template: The cost of goods sold is basically the sum of the cost of goods or merchandise that was sold to customers of the company. Purchases in current period → the cost of purchases made during the current period. The way, you can get rid of manual calculation.

4 Cost Of Goods Sold Templates Excel xlts

Fifo, lifo, and weighted average. Web smartsheet contributor andy marker april 6, 2022 try smartsheet for free creating a profit and loss statement can be daunting, but using a template can help simplify the process. Web cost of goods sold template has basic formulas or formats is make that calculation easier press automatic. Purchases in current period → the cost.

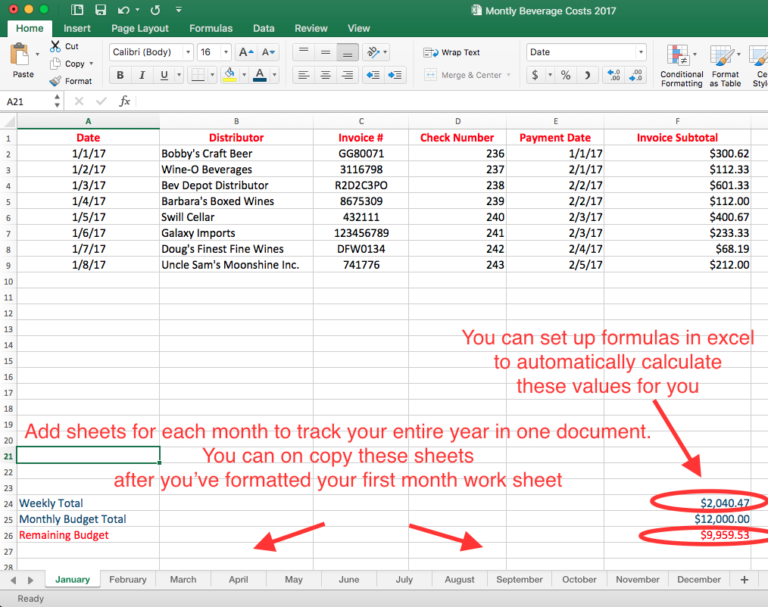

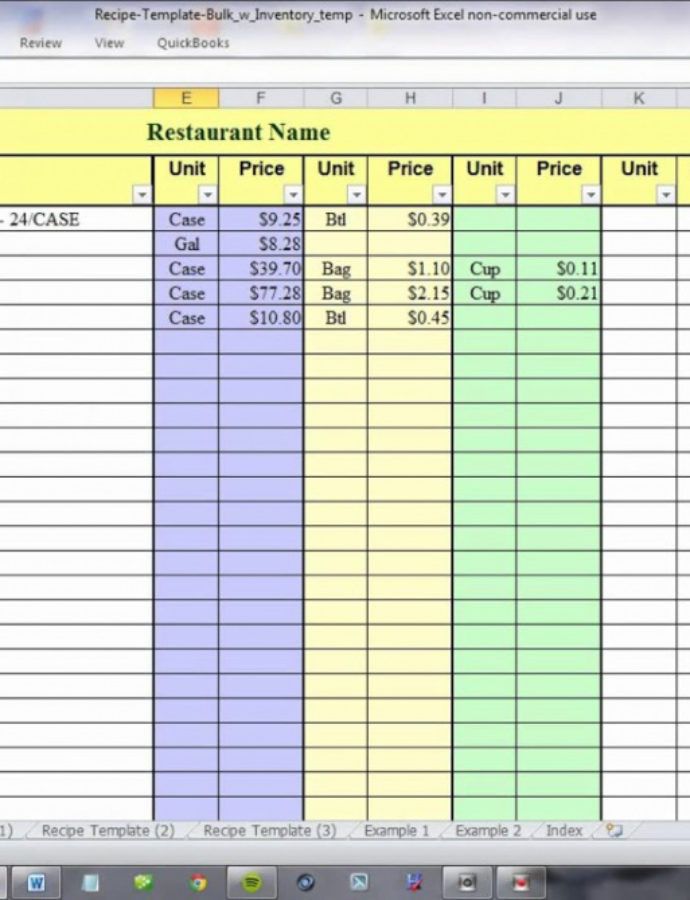

Restaurant Cost Of Goods Sold Spreadsheet within How To Take Bar

Beginning inventory → the amount of inventory rolled over (i.e. Web cost of goods sold (cogs) template. In the income statement for a business one of the key figures is the cost of goods sold (cogs). This cost of goods sold template demonstrates three methods of cogs accounting: Below is a screenshot of the cogs template:

Cost of Goods Sold Sheet Template Template124

This figure tells anyone reviewing the financial statements how much it cost for the business to provide the goods and services it sells to customers. Beginning inventory is the inventory value at the start of an accounting period. This figure includes materials and labor costs, but excludes indirect expenses, such as sales and distribution costs. Below is a screenshot of.

Editable Cost Of Goods Manufactured Excel Model Template Cost Of Goods

This cost of goods sold template demonstrates three methods of cogs accounting: Beginning inventory → the amount of inventory rolled over (i.e. This figure tells anyone reviewing the financial statements how much it cost for the business to provide the goods and services it sells to customers. Fifo, lifo, and weighted average. Enter your name and email in the form.

Cost of Goods Sold Excel Template CFI Marketplace

This cost of goods sold template demonstrates three methods of cogs accounting: Web smartsheet contributor andy marker april 6, 2022 try smartsheet for free creating a profit and loss statement can be daunting, but using a template can help simplify the process. Web cost of goods sold template has basic formulas or formats is make that calculation easier press automatic..

Cost of Goods Sold Statement Templates 13+ Free Printable Xlsx, Docs

Web cost of goods sold (cogs) =. Below is a screenshot of the cogs template: Web cost of goods sold. Web cost of goods sold formula. Leftover) from the prior period.

Cost Of Goods Sold Spreadsheet Template

This cost of goods sold template demonstrates three methods of cogs accounting: Enter your name and email in the form below and download the free template now! This figure tells anyone reviewing the financial statements how much it cost for the business to provide the goods and services it sells to customers. The way, you can get rid of manual.

Purchases In Current Period → The Cost Of Purchases Made During The Current Period.

The cost of goods (cog) forecast template and spreadsheet include categories for five types of your products and services, with slots for the cost of goods for each product or service and the number of products and services sold. Enter the cost of goods sold by your company. Enter your name and email in the form below and download the free template now! Review your gross profit (i.e., your gross revenue minus cogs) for accuracy.

Fifo, Lifo, And Weighted Average.

Beginning inventory is the inventory value at the start of an accounting period. Web cost of goods sold (cogs) =. Web cost of goods sold template has basic formulas or formats is make that calculation easier press automatic. Web cost of goods sold.

The Way, You Can Get Rid Of Manual Calculation And Formatting.

The cost of goods sells excel templates are not prepared on a speciality business or industry even anyone could download the edit the template to make it fit used individual. Beginning inventory → the amount of inventory rolled over (i.e. Web cost of goods sold formula. Web smartsheet contributor andy marker april 6, 2022 try smartsheet for free creating a profit and loss statement can be daunting, but using a template can help simplify the process.

The Cost Of Goods Sold Is Basically The Sum Of The Cost Of Goods Or Merchandise That Was Sold To Customers Of The Company.

This figure includes materials and labor costs, but excludes indirect expenses, such as sales and distribution costs. Purchases are the total cost incurred from manufacturing to transporting goods and services. Below is a screenshot of the cogs template: Leftover) from the prior period.