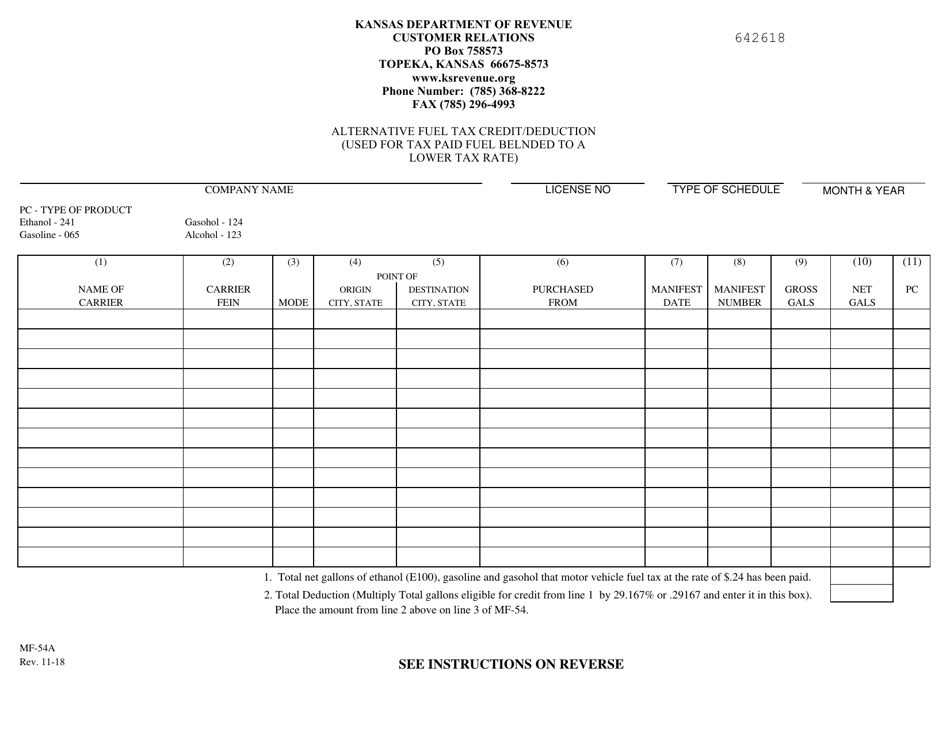

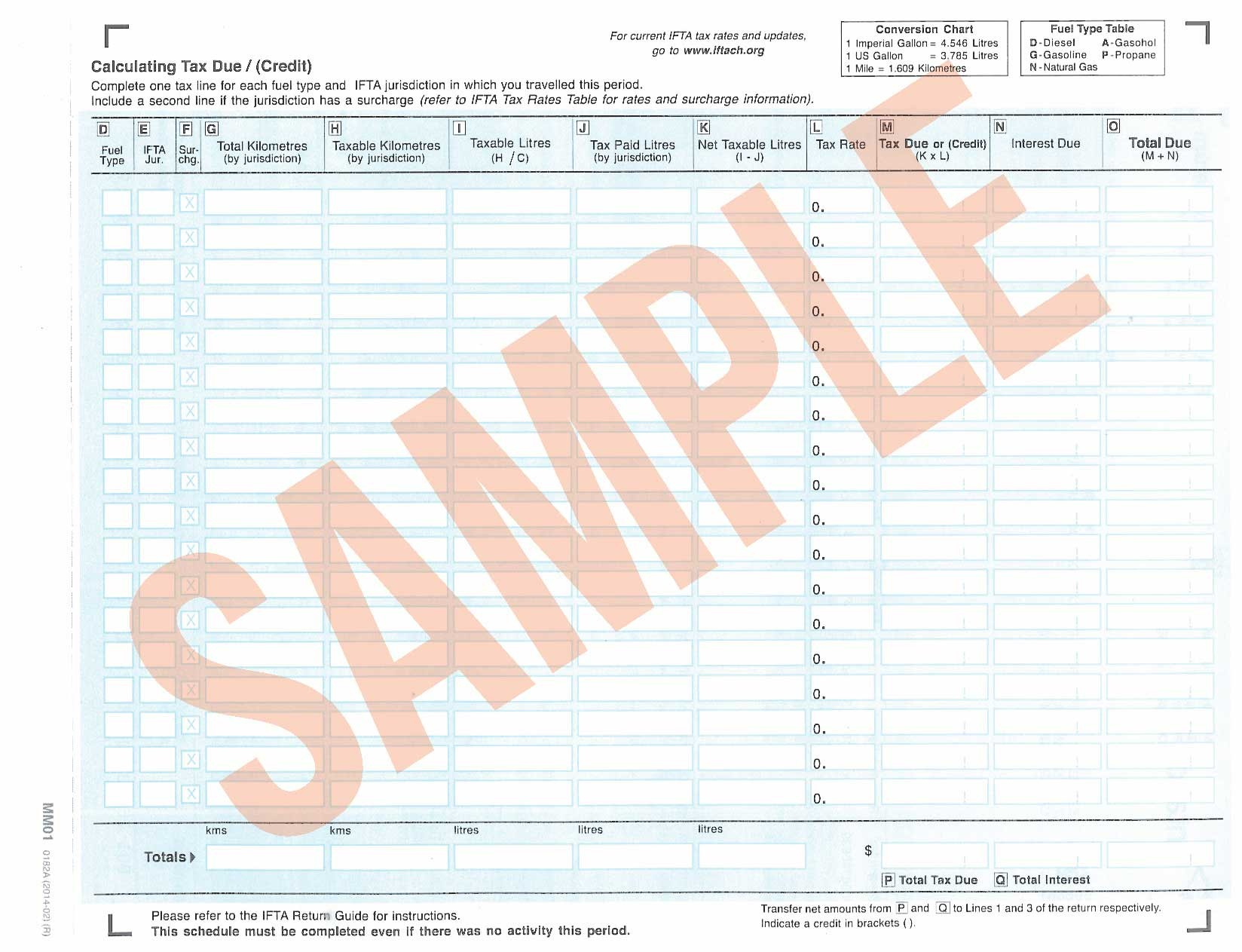

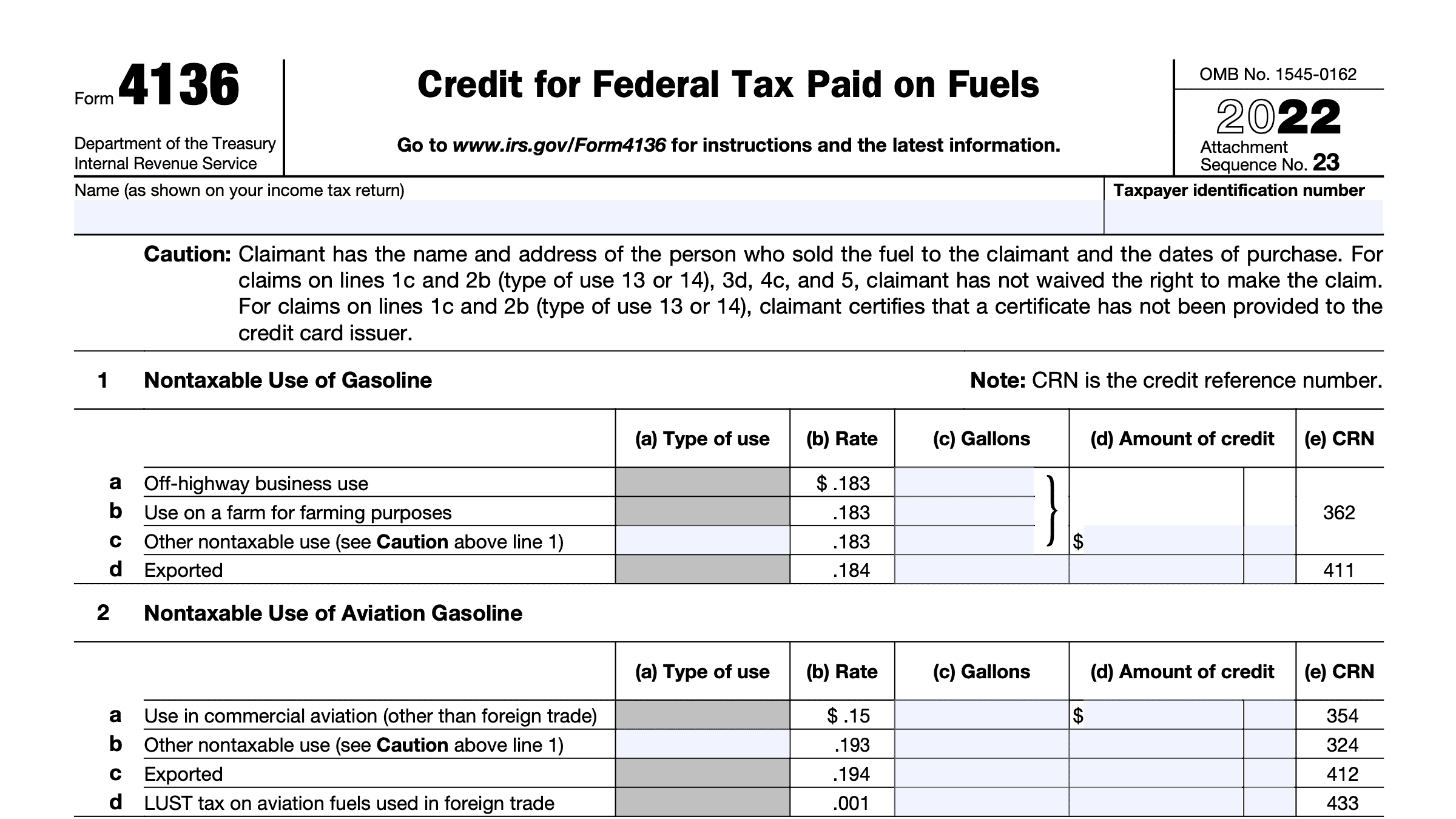

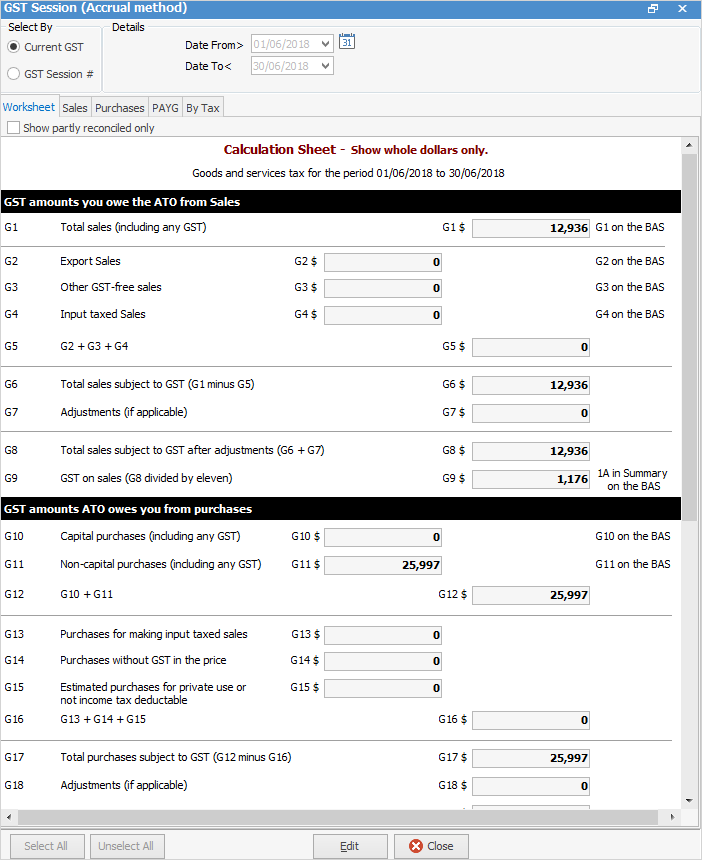

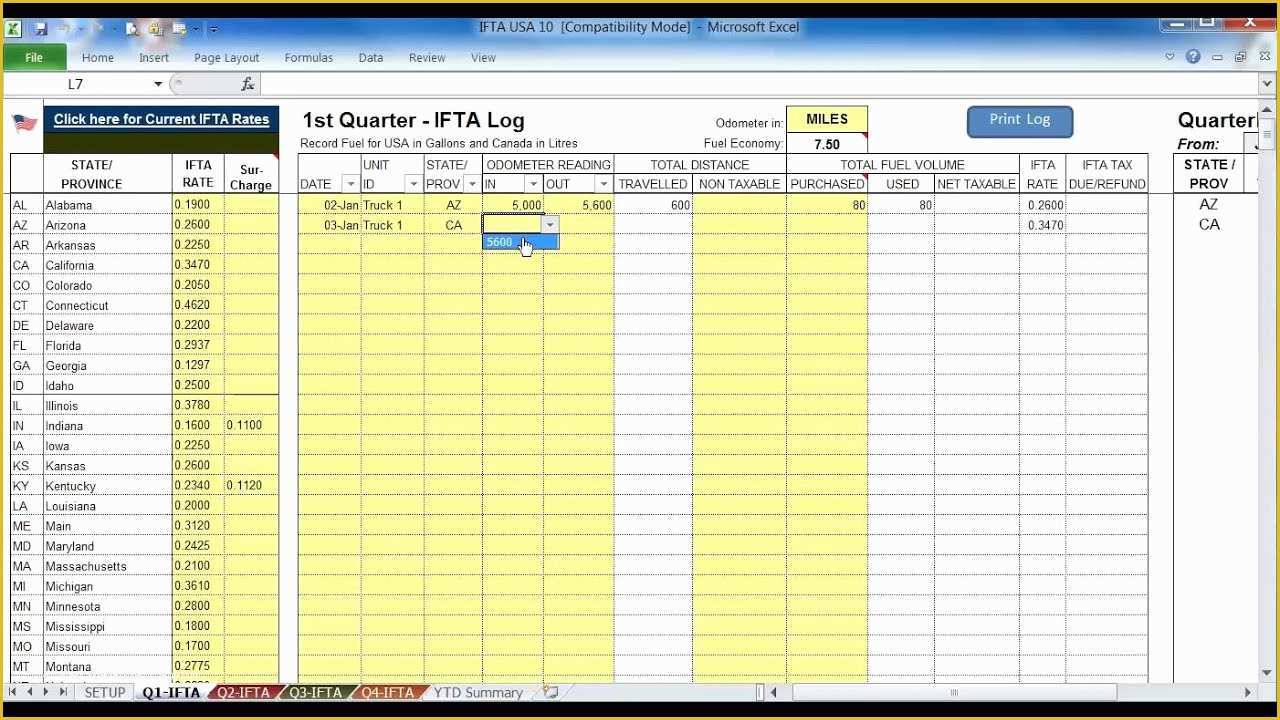

Fuel Tax Credits Calculation Worksheet - To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. There are three steps to calculate your fuel tax credits using our worksheet step 1: You must be registered for gst and fuel. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Work out your eligible quantities work out how much fuel (liquid. Use the rate that applied when you acquired the fuel. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas.

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Use the rate that applied when you acquired the fuel. You must be registered for gst and fuel. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Work out your eligible quantities work out how much fuel (liquid. There are three steps to calculate your fuel tax credits using our worksheet step 1: Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes.

Use the rate that applied when you acquired the fuel. Work out your eligible quantities work out how much fuel (liquid. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Work out how much fuel (liquid or gaseous) you acquired for each business activity. You must be registered for gst and fuel. There are three steps to calculate your fuel tax credits using our worksheet step 1: Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes.

Fuel Tax Credit Calculation Worksheet

Work out how much fuel (liquid or gaseous) you acquired for each business activity. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. You must be registered for gst and fuel. There are three steps to calculate your fuel tax credits using our worksheet step 1: Use the rate that applied when you acquired the.

Fuel Tax Credits Calculation Worksheet

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. There are three steps to calculate your fuel tax credits using our worksheet step 1: Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. To help you determine.

Fuel Tax Credits Calculation Worksheet

Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. You must be registered for gst and fuel. Work out your eligible quantities work out how much fuel (liquid. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Work out how much fuel (liquid or gaseous) you acquired.

Fuel Tax Credit Calculation Worksheet

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. You must be registered for gst and fuel. Work out how much fuel (liquid or gaseous) you acquired for.

Fuel Tax Credits Calculation Worksheet

Work out your eligible quantities work out how much fuel (liquid. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. There are three steps.

Fuel Tax Credit Calculation Worksheet

You must be registered for gst and fuel. Work out your eligible quantities work out how much fuel (liquid. Use the rate that applied when you acquired the fuel. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Learn how to calculate and claim fuel tax credits for your business activity statement.

Fuel Tax Credit Calculation Sheet

Work out how much fuel (liquid or gaseous) you acquired for each business activity. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with.

Fuel Tax Credits 2024 Pdf Vonni Susana

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Use the rate that applied when you acquired the fuel. There are three steps to calculate your fuel tax credits using our worksheet step 1: Work out how much fuel (liquid or gaseous) you acquired for each business activity. Use this worksheet to.

Fuel Tax Credit Calculation Worksheet

You must be registered for gst and fuel. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Use the rate that.

Fuel Tax Credits 2024 Jacqui Nissie

Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. There are three steps to calculate your fuel tax credits using our worksheet step 1: To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Work out your eligible.

Work Out How Much Fuel (Liquid Or Gaseous) You Acquired For Each Business Activity.

Use the rate that applied when you acquired the fuel. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas.

Work Out Your Eligible Quantities Work Out How Much Fuel (Liquid.

There are three steps to calculate your fuel tax credits using our worksheet step 1: You must be registered for gst and fuel. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes.