Tax And Interest Deduction Worksheet Turbotax - The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Tax and interest deduction worksheet: Part i contains general information on home mortgage interest, including points. The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Part i contains general information on home mortgage interest, including points. The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Tax and interest deduction worksheet: The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Part i contains general information on home mortgage interest, including points. Tax and interest deduction worksheet: Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

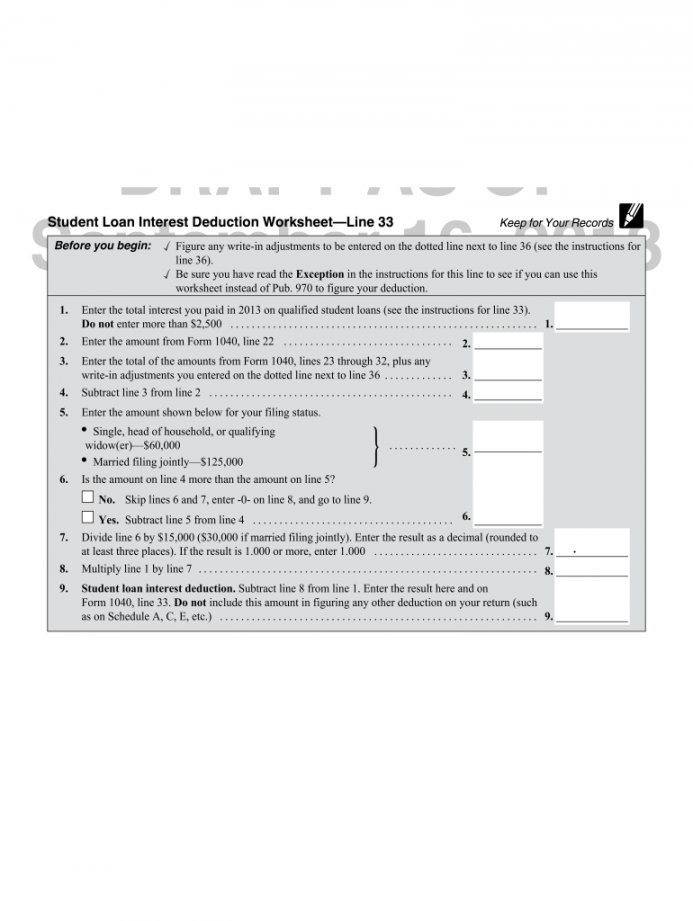

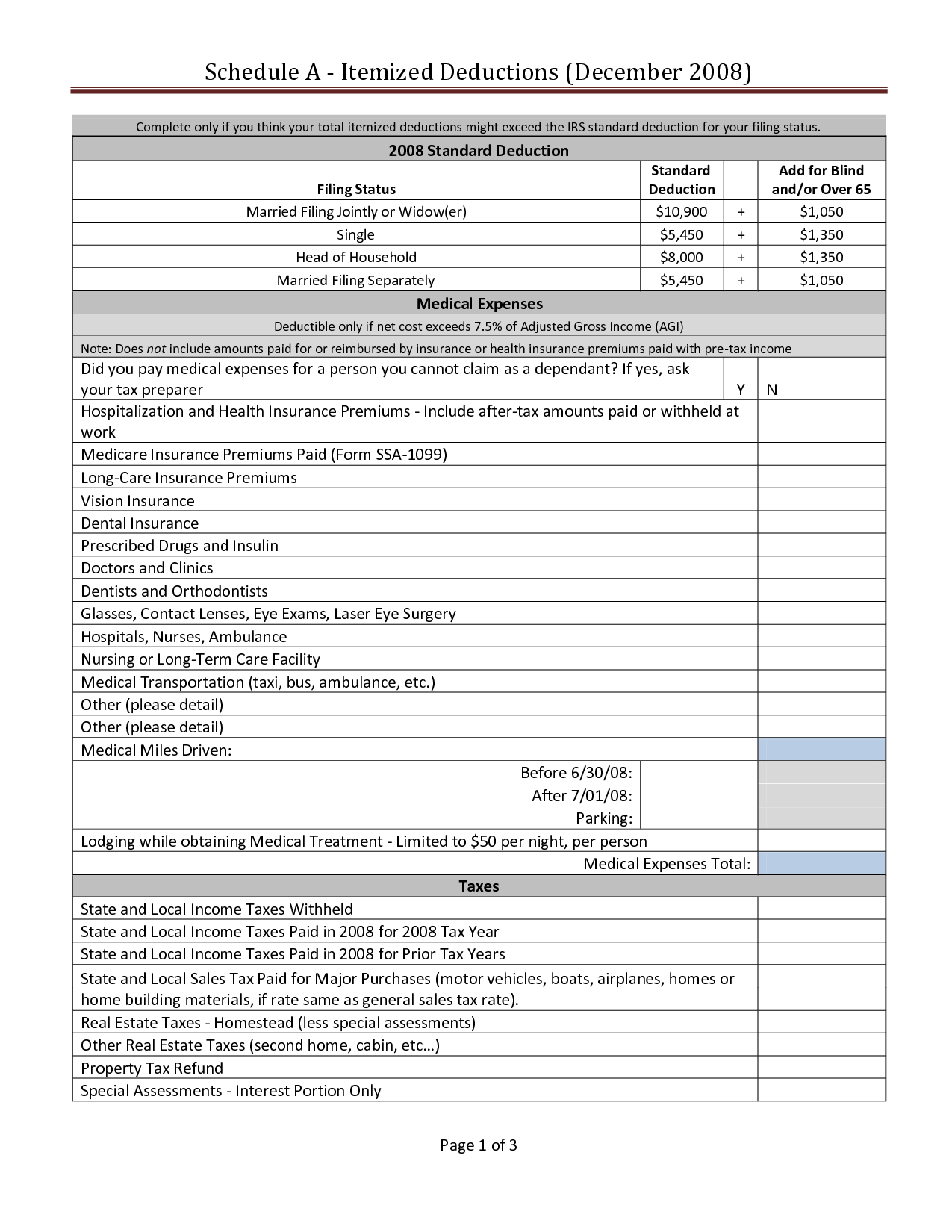

Standard Deduction Worksheets

Tax and interest deduction worksheet: Part i contains general information on home mortgage interest, including points. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Generally, home interest is deductible on a form.

Itemized Deduction Small Business Tax Deductions Worksheet 8

The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Tax and interest deduction worksheet: Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. The tax and interest deduction worksheet helps taxpayers compute.

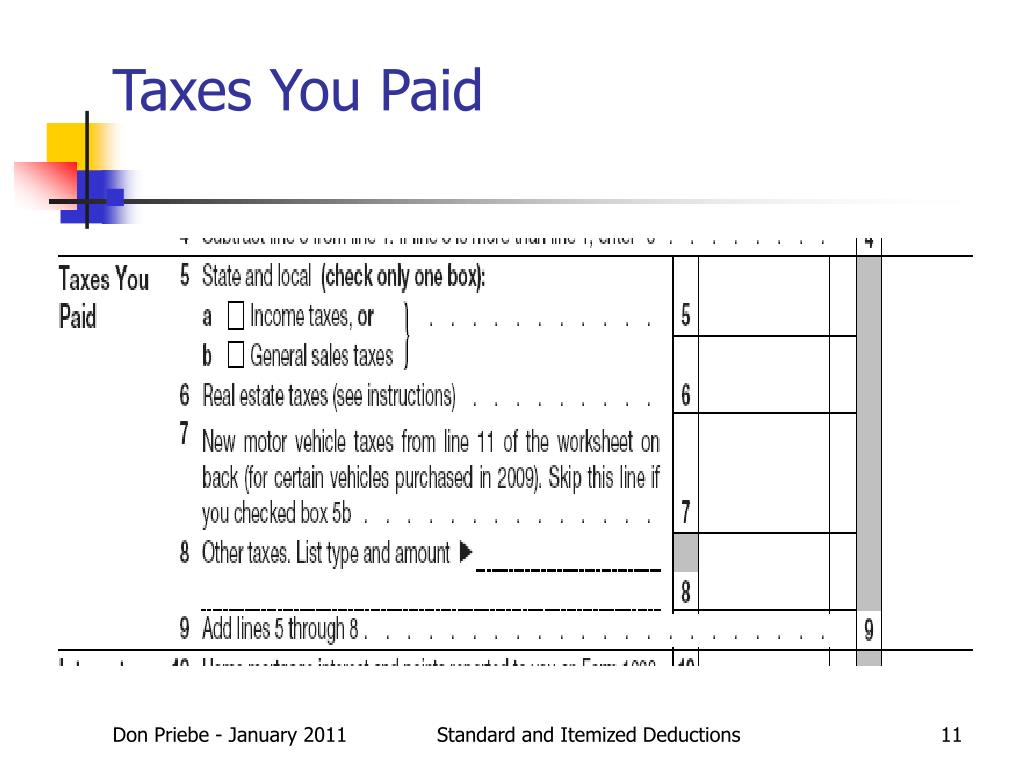

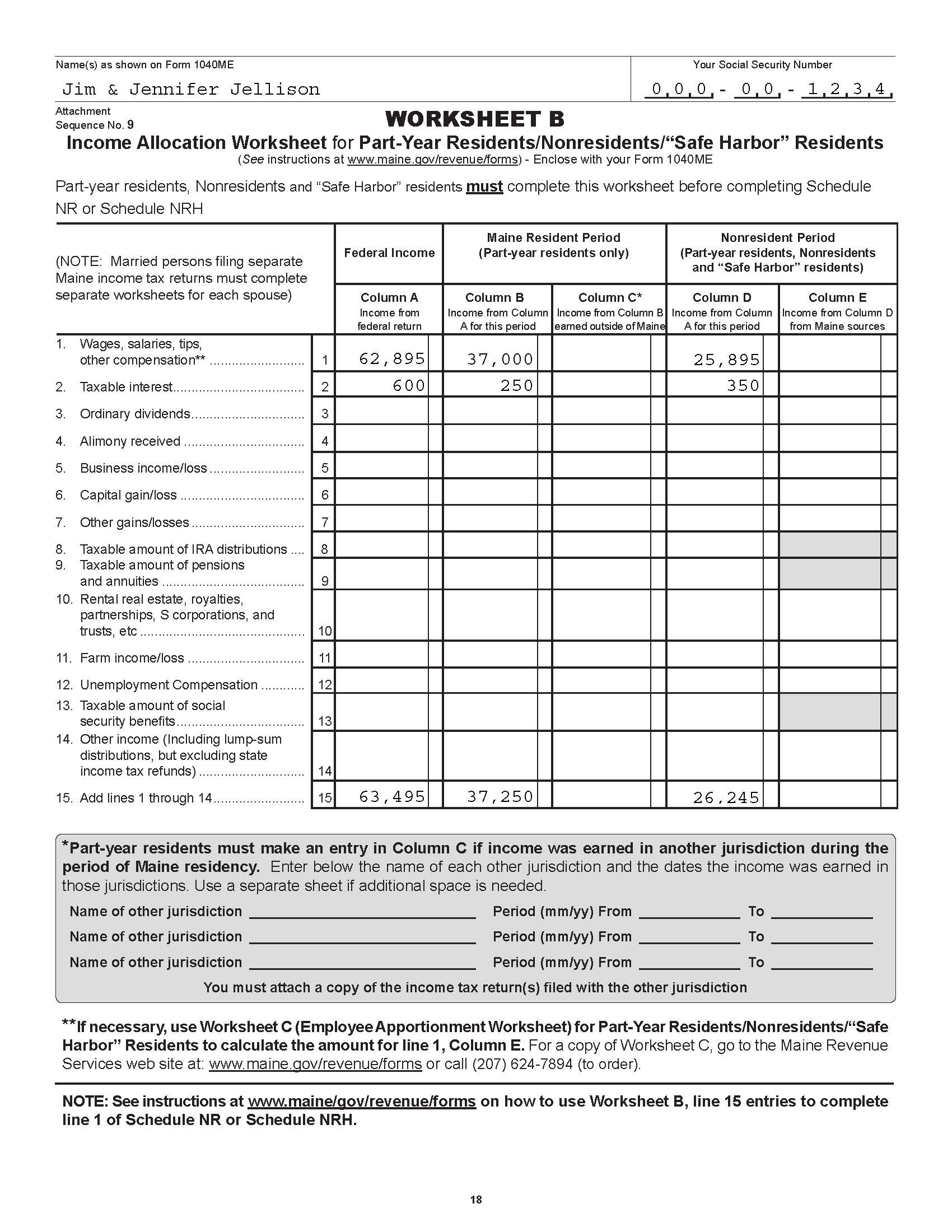

Tax And Interest Deduction Worksheets

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. Part i contains general information on home mortgage interest, including points. Tax and interest deduction worksheet: The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040.

Tax And Interest Deduction Worksheet Turbotax Printable Word Searches

The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Part i contains general information on home mortgage interest, including points. Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. The tax and interest deduction worksheet is used if.

Free tax and interest deduction worksheet, Download Free tax and

Tax and interest deduction worksheet: Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. The tax and interest deduction worksheet helps taxpayers compute.

Tax And Interest Deduction Worksheet

Part i contains general information on home mortgage interest, including points. Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. The tax and interest deduction worksheet is used if.

Realtor Tax Deductions Worksheets

The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Part i contains general information on home mortgage interest, including points. Tax and interest deduction worksheet: The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Generally, home interest is deductible on a form.

Tax And Interest Deduction Worksheet Turbotax Worksheets Library

Tax and interest deduction worksheet: The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Part i contains general information on home mortgage interest, including points. Generally, home interest is deductible on a form.

Tax And Interest Deduction Worksheet 2023

Tax and interest deduction worksheet: The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. The tax and interest deduction worksheet helps taxpayers compute.

Tax And Interest Deduction Worksheets

The tax and interest deduction worksheet is used if you are going to itemized deductions on a form 1040 schedule a. Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with.

The Tax And Interest Deduction Worksheet Is Used If You Are Going To Itemized Deductions On A Form 1040 Schedule A.

Tax and interest deduction worksheet: Part i contains general information on home mortgage interest, including points. Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax.