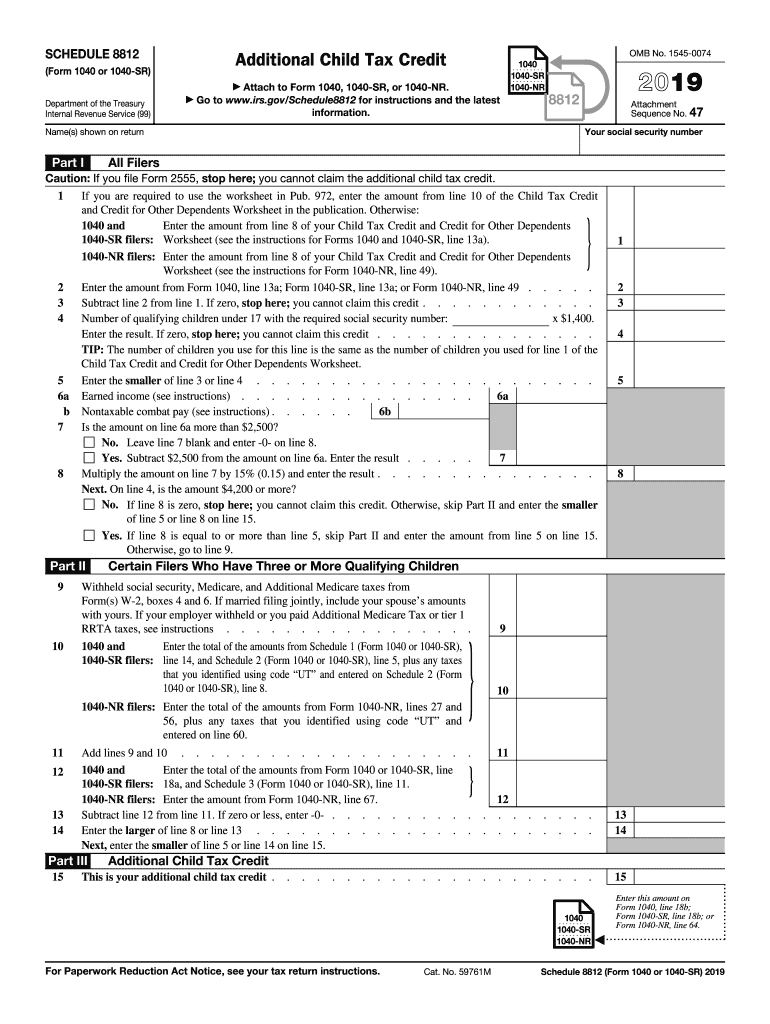

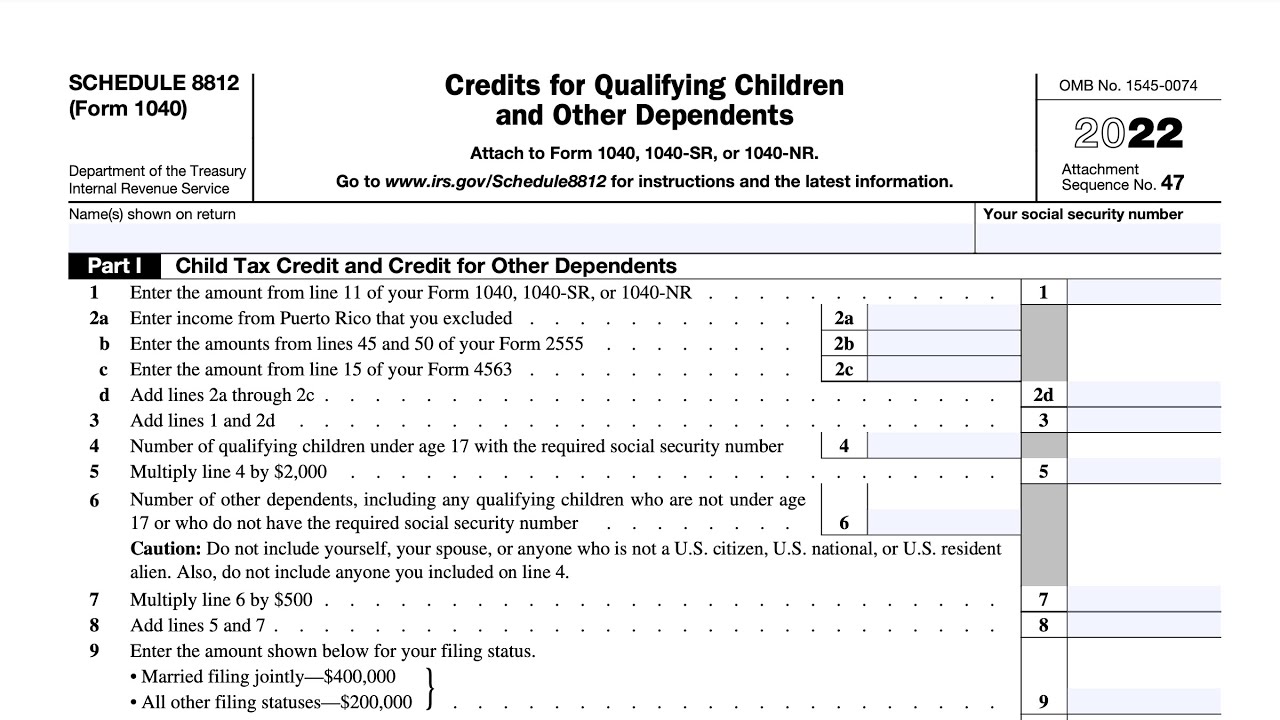

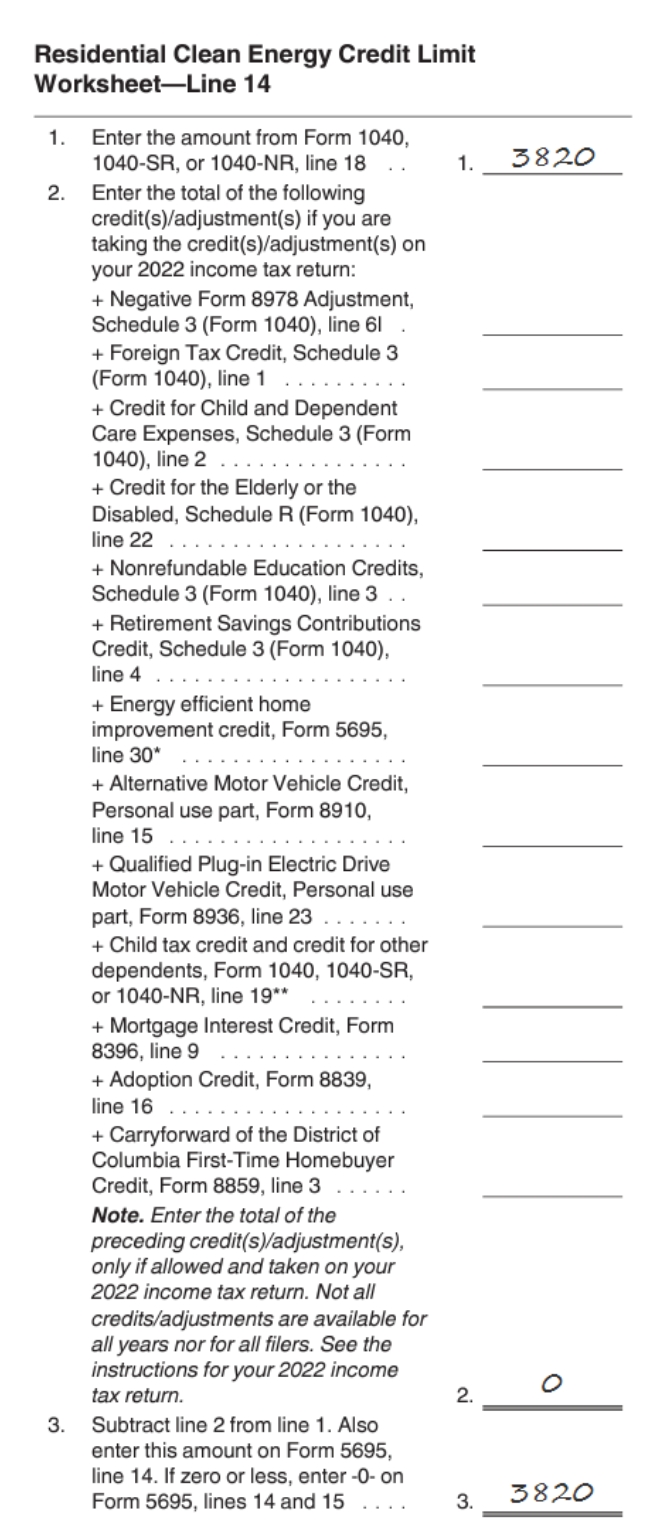

What Is The Credit Limit Worksheet A For Form 8812 - Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. Finally found the credit limit worksheet a. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. 2022 schedule 8812 credit limit worksheet a keep for your records 1. In credit limit worksheet a, start by entering the amount from line 18 of your form. It is located in the instructions.

The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Finally found the credit limit worksheet a. 2022 schedule 8812 credit limit worksheet a keep for your records 1. It is located in the instructions. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. In credit limit worksheet a, start by entering the amount from line 18 of your form.

It is located in the instructions. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Finally found the credit limit worksheet a. In credit limit worksheet a, start by entering the amount from line 18 of your form. 2022 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one.

Form 8812 Credit Limit Worksheet A Printable Word Searches

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. Finally found the credit limit worksheet a. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out..

Credit Limit Worksheet A Schedule 8812

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Finally found the credit limit worksheet a. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out..

Schedule 8812 Credit Limit Worksheet A

In credit limit worksheet a, start by entering the amount from line 18 of your form. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. The schedule 8812 credit limit worksheet a is an.

2022 Schedule 8812 Credit Limit Worksheet A

Finally found the credit limit worksheet a. 2022 schedule 8812 credit limit worksheet a keep for your records 1. In credit limit worksheet a, start by entering the amount from line 18 of your form. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. The schedule 8812 credit limit worksheet a.

2023 Schedule 8812 Credit Limit Worksheet A

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. In credit limit worksheet a, start by entering the amount from line 18 of your form. 2022 schedule 8812 credit limit worksheet a keep for.

Irs Form 8812 Credit Limit Worksheet A

In credit limit worksheet a, start by entering the amount from line 18 of your form. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. Finally found the credit limit worksheet a. It is located in the instructions. 2022 schedule 8812 credit limit worksheet a keep for your records 1.

What is the credit limit worksheet? Leia aqui What is line 5 worksheet

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In credit limit worksheet a, start by entering the amount from line 18 of your form. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. The schedule 8812 credit limit worksheet a is an.

2023 Schedule 8812 Credit Limit Worksheet A

2022 schedule 8812 credit limit worksheet a keep for your records 1. Finally found the credit limit worksheet a. It is located in the instructions. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

2022 Irs Form 8812 Credit Limit Worksheet A

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. It is located in the instructions. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. In.

What Is The Credit Limit Worksheet A For Form 8812

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. It is located in the instructions. 2022 schedule 8812 credit limit worksheet a keep for your records 1. In credit limit worksheet a, start by entering the amount from line 18 of your form. If your employer withheld or you paid additional.

Complete The Credit Limit Worksheet B Only If You Meet All Of The Following. You Are Claiming One.

Finally found the credit limit worksheet a. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. In credit limit worksheet a, start by entering the amount from line 18 of your form. It is located in the instructions.

2022 Schedule 8812 Credit Limit Worksheet A Keep For Your Records 1.

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.