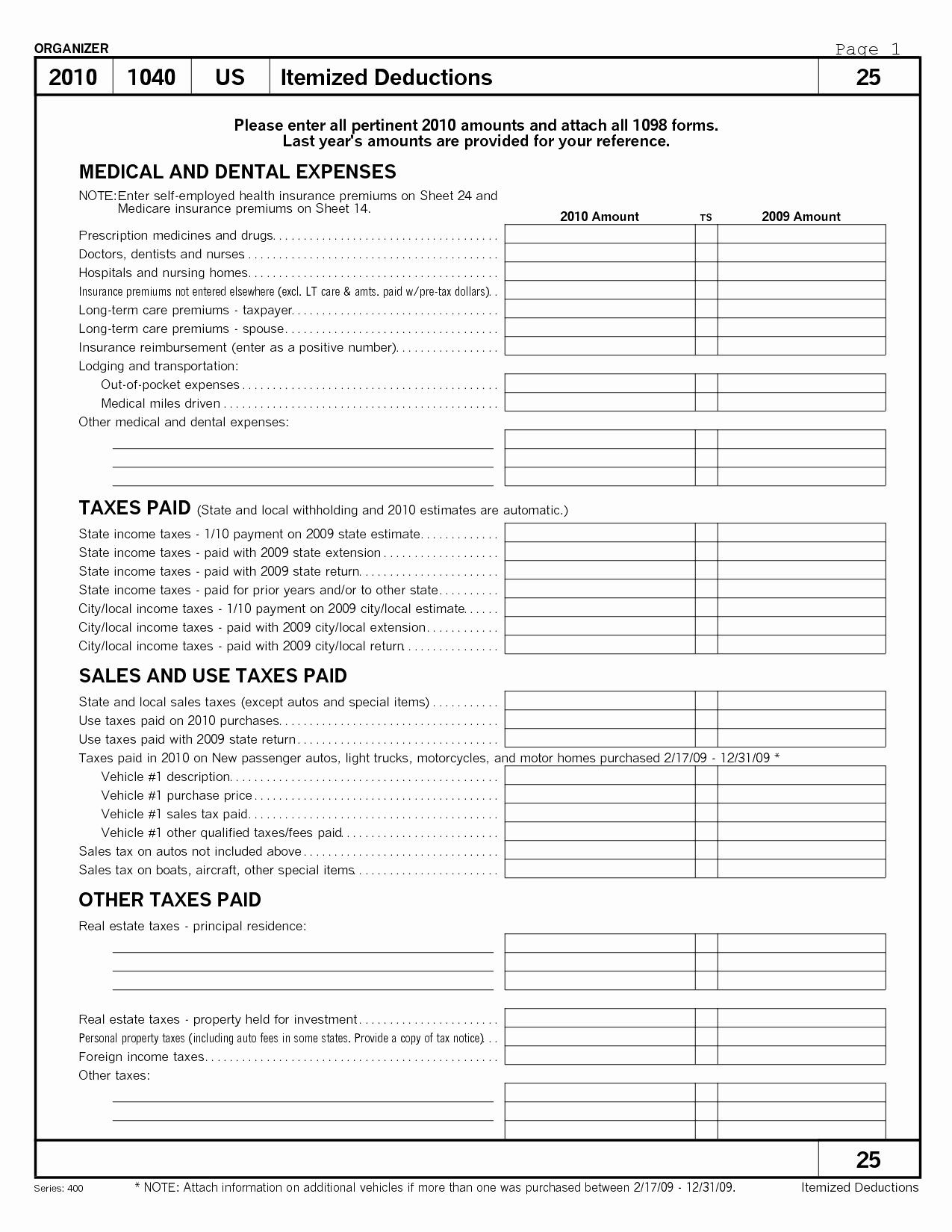

Worksheet For Tax Deductions - Enter the first description, the amount, and continue. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Enter the information for the next item. Medical and dental expenses are deductible only to the extent they exceed 7.5%. They will be totaled on the input line and carried. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550.

They will be totaled on the input line and carried. Enter the information for the next item. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Enter the first description, the amount, and continue. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel.

They will be totaled on the input line and carried. In most cases, your federal income tax will be less if you take the. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Enter the information for the next item. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Enter the first description, the amount, and continue.

Tax worksheet tax deductible expense log tax deductions log tax

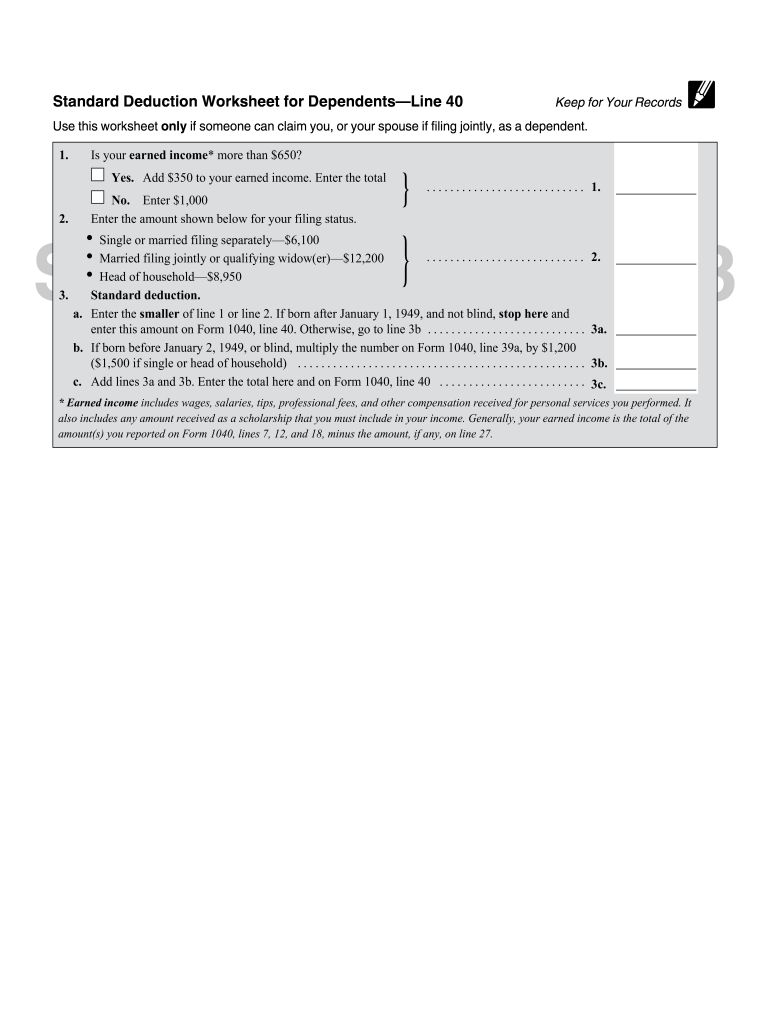

We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Medical and dental expenses are deductible only to.

Tax Deductions Worksheets

Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Enter the first description, the amount, and continue. Download these income tax worksheets.

Printable Itemized Deductions Worksheet

We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. In most cases, your federal income tax will be less if you take the. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. They will be totaled on the input line.

Small Business Tax Deductions Worksheets

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Enter the information for the next item. They will be totaled on the input line and carried. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel. Medical and.

Self Employed Tax Deductions Worksheet

Enter the information for the next item. They will be totaled on the input line and carried. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Medical and dental expenses are deductible only to the extent they exceed 7.5%. In most cases, your federal income tax will.

Tax Deduction Worksheets

They will be totaled on the input line and carried. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. In most cases, your federal income tax will be less if you take the. Enter the information for the next item. Medical and dental expenses are deductible only.

Deductions Worksheet For Taxes

In most cases, your federal income tax will be less if you take the. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Enter the first description, the amount, and continue. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Prepare your federal income tax return with the help.

Self Employed Tax Deductions Worksheet Small Business Tax De

Enter the first description, the amount, and continue. Medical and dental expenses are deductible only to the extent they exceed 7.5%. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Enter the information for the next item. Prepare your federal income tax return with the help of.

Truck Driver Tax Deductions Worksheet

Enter the first description, the amount, and continue. They will be totaled on the input line and carried. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take.

Standard Deduction Worksheets

Enter the information for the next item. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. They will be totaled on the input line and carried. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Prepare your federal income tax.

Download These Income Tax Worksheets And Organizers To Maximize Your Deductions And Minimize Errors And Omissions.

Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel. They will be totaled on the input line and carried. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550. Medical and dental expenses are deductible only to the extent they exceed 7.5%.

Enter The First Description, The Amount, And Continue.

In most cases, your federal income tax will be less if you take the. Enter the information for the next item.